ANTI-BRIBERY AND ANTI-CORRUPTION POLICY AND PROCEDURE

1. Introduction

1.1. This Policy and Procedure is drawn up to ensure that Capital Dynamics Asset Management (“Company”)’s operation is in compliance with the MACC Act, MACC (Amendment) Act 2018, and the Prime Minister’s Directive in respect of Integrity & Governance, along with any relevant laws, regulations and guidelines with regards to anti-bribery and anti-corruption in Malaysia.

1.2. This Policy and Procedure is put in place in light of Section 17A of the MACC Act which came into force on 1 June 2020. The aim of this Policy and Procedure is to foster the growth of a corporate culture which is free of corruption within CDAM. A complete understanding of CDAM’s culture against bribery and corruption is therefore essential to a continuous constructive relationship between CDAM and its employees, business partners and agents.

1.3. Section 17A imposes corporate liability against commercial organizations including CDAM and personal liability against the Management of the Company if a person associated with the Company corruptly gives, agrees to give, promises or offers to any person any gratification whether for the benefit of that person or another person with an intent to:

- (i) Obtain or retain business for the Company; or

- (ii) Obtain or retain an advantage in the conduct of business for the Company.

(“Bribery and Corruption”)

Management of the Company includes a person who is a CDAM’s director, controller, officer or partner or who is concerned in the management of its affairs. A person is associated with the Company if he is a director, partner or an employee of CDAM or he is a person who performs services for or on behalf of CDAM.

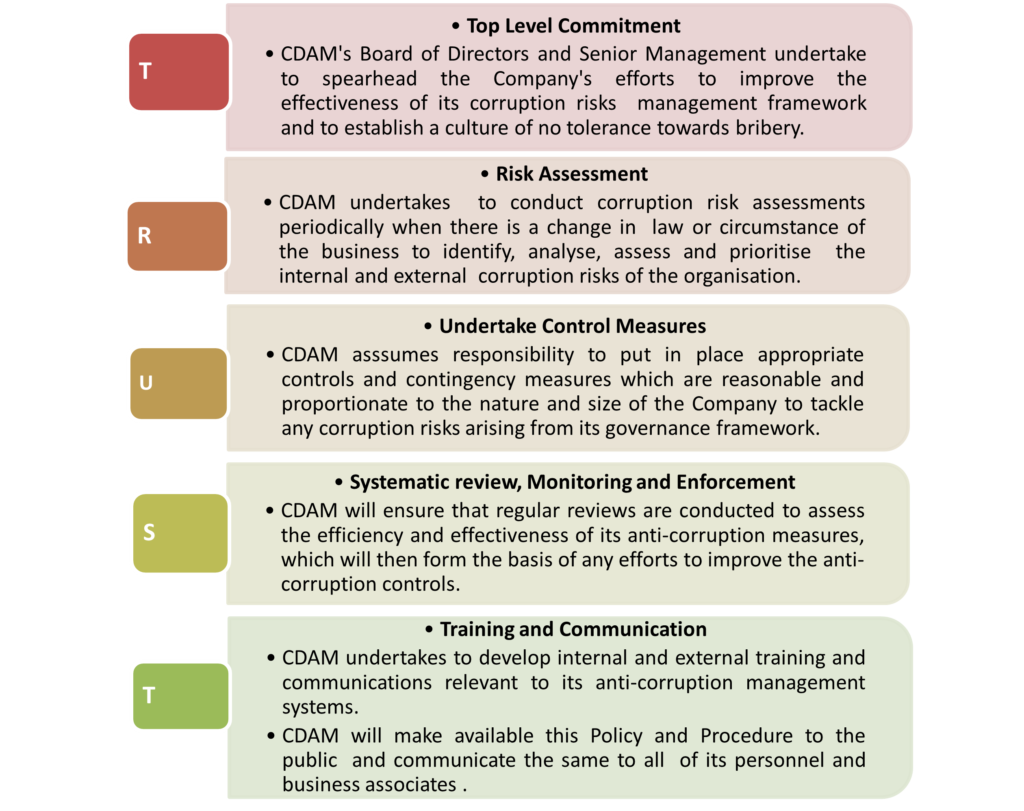

1.4. As such, CDAM undertakes to ensure that it has in place adequate procedures to prevent persons associated with the Company from undertaking Bribery and Corruption. In this regard, the Company is guided by 5 core principles (R.U.S.T) as outlined in the Guidelines on Adequate Procedures issued by the National Centre for Governance, Integrity and Anti-Corruption (“GIACC”).

T.R.U.S.T Guiding Principles

2. Policy Statement

2.1. The Company is committed to the highest ethical standards and integrity in conducting business in compliance with all applicable laws, including the MACC Act.

2.2. The Company adopts no tolerance approach against all forms of Bribery and Corruption and takes a strong stance against such acts.

2.3. Notwithstanding Bribery and Corruption envisaged in Section 1.3 of this Policy and Procedure, bribery and corruption may take the form of exchange of money, goods, services, property, privilege and/or preferential treatment

2.4. This Policy and Procedure apply to the Company’s business dealings with commercial and government entities, including interactions with their directors, employees, agents and other appointed representatives.

2.5. The Company adopts a “No Gifts” Policy save for certain special circumstances where accepting and/or giving Gifts are allowed. Nonetheless, the Company’s “No Gifts” Policy will be strictly observed when it comes to dealing with government entities, government related agencies and/or its officials notwithstanding the value of the Gifts.

2.6. The Company awards contracts based on merits and shall consider the awarding of contracts on an arm’s length basis.

2.7. This Policy and Procedure shall take reference and be guided by CDAM’s Compliance Policy and Procedures, on matters pertaining to its Business Principles and Employees’ Conduct/Code of Ethics.

3. Scope

3.1. This Policy and Procedure apply to the following persons associated to CDAM:-

-

- The Directors and employees of the Company; and

- Business associates or any other parties performing services for and on behalf of the Company.

- (collectively be referred to as “the Parties”)

3.2. In the event of doubt in relation to this Policy and Procedure, the Parties should immediately contact the Compliance Officer of the Company for clarification.

4. Responsibilities of the Parties

4.1. The Parties are required to be familiar with the requirements and directives of this Policy and Procedure and communicate them to their respective subordinates. In the case of CDAM’s business associates such as the service providers, the Parties are required to communicate this Policy and Procedure to their respective employees servicing the Company.

4.2. CDAM and its employees are responsible in complying with this Policy and Procedure which includes the following:-

-

- Promptly record all transactions of Gifts accurately and in reasonable detail;

- Any suspicious transactions should be escalated to the Compliance Officer for guidance on next course of action;

- Promptly report violations or suspected violations through CDAM’s reporting channels; and

- Attend and complete all trainings and assessments in relation to the Policy and Procedure (applicable to Directors, employees or agents of the Company)

4.3. The Parties should avoid any possible conflicts of interest situation and if unavoidable, shall disclose the nature of the conflict to the Company as soon as practicable and they must not use their position to gain or to cause disadvantage to the Company.

5. Business Associate

5.1 The Company expects all its Business Associates to refrain from Bribery and Corruption.

5.2 In the event that any suspected Bribery and Corruption arise in the collaboration between CDAM and its Business Associates, the Company has the right to terminate the business relationship with the said Business Associate and shall seek an alternative Business Associate. For this purpose, the Company will include clauses in its contracts with its Business Associates that would enable the termination of contract in the event that suspicion of Bribery and/or Corruption arisen.

5.3 Prior to entering into any formalised relationships with the Business Associates, the Company shall conduct due diligence which include but not limited to searches in the relevant databases, background checks and conducting interviews on the relevant parties to identify the suspicious relationship and documenting the reasons for choosing one particular Business Associate over another.

5.4 CDAM’s Business Associates are also required to execute a declaration that they have read and understood this Policy and Procedure and undertake to comply with the same for a continuous business relationship with CDAM for the benefit of all parties.

6. Non-Compliance

6.1 Failure to comply with this Policy and Procedure, whether intentional or not, may lead to grave consequences imposed against the offender such as a disciplinary action and /or criminal liability incurred upon the individual(s) involved.

6.2 The Company would take immediate action against any party who did not adhere to this Policy and Procedure. This may include but not limited to the termination of, business arrangements, initiation of legal action and/or notification to the authorities.

6.3 Any person who commits an offence under Sections 16, 17, 20, 21, 22 and 23 of the MACC Act, shall on conviction be liable to

(a) imprisonment for a term not exceeding twenty (20) years; and

(b) a fine of not less than five (5) times the sum or value of the gratification which is the subject matter of the offence, where such gratification is capable of being valued or is of a pecuniary nature, or ten thousand ringgit, whichever is the higher.

6.4 The Company, its director, controller, officer or who is concerned with the management of its affairs, commits an offence pursuant to Section 17A(1) if a person associated with the Company commits Corruption and/or Bribery.

The Company and any Parties found guilty by the authorities pursuant to Section 17A(2) of the MACC Act, is punishable by a fine not less than ten (10) times the sum or value of the gratification which is the subject matter of the offence, where the gratification is capable of being valued or is of a pecuniary nature, or RM1.0 million, whichever is higher or imprisonment for a term not exceeding 20 years or both.

7. Gifts, Entertainment, Hospitality, Travel, Political Donation and Sponsorship (“Gifts”)

7.1 Accepting Gifts

7.1.1 CDAM does NOT allow accepting any Gifts from any third party whether it is in a physical or in an intangible form to reduce the likelihood of misconduct, conflict of interest and corruption. This includes festive season gift exchanges, door gift during certain events, i.e. analyst briefing and/or during site-visit, as well as sponsorship for annual dinner, wedding, etc.

7.1.2 All employees must graciously decline the offering of Gifts to avoid offending any third party, event host and/or organizer. Therefore, it is important to thoroughly comprehend this Policy and Procedure to CDAM’s Business Associates to avoid misconception and negative impact on CDAM’s reputation.

7.1.3 It is also imperative for all employees to tactfully communicate CDAM’s Policy and Procedure to a third party of not accepting gift in any form and manner.

7.2 Procedures and Guiding Principles for Accepting Gifts

7.2.1 Exceptions may be given to the above gift policy under certain circumstances:-

- (a) Where it is impossible to return the gift(s), e.g. there is no return address or known personnel to return the Gifts and/or the sender refused to accept the returned Gift(s).

- (b) Where the Gift(s) is a sample product.

- (c) Where the Gift(s) is from sponsored events given to everyone and not just employees of CDAM.

- (d) Where the Gift(s) is reasonable in value.

- (e) Where the acceptance of the Gift(s) would not cause any conflict of interest.

- (f) Where the recipient(s) of the Gift(s) would not be under any obligation to return a favor.

- (g) Where the acceptance of the Gift(s) would not compromise the impartiality of professional judgment.

- (h) Where the Gift(s) is a one-off transaction taking into account of rule (d) above.

- (i) Where the Gift(s) is proportionate and appropriate given the nature of the relationship between the giver and the recipient, e.g. where the giver is a shareholder and is related to the employee who received the Gift(s) in his or her personal capacity.

7.2.2 The application of these exceptions are subject to a written justification given by the employee to the Compliance Officer that returning the Gifts will result in a negative reaction from the third party and such request will be brought to the management for deliberation and approval.

7.2.3 Employees may also receive advance third party’s invitation to an event or dining such as an invitation to lunch, coffee and/ or tea which could be considered as a form of gift envisaged by this Policy and Procedure. Employees must inform Compliance Officer and discuss on the best approach to manage the invitation to ensure compliance with this Policy and Procedure, whilst taking into account the purpose of such an invitation, cultural sensitivity, festive season, types of occasion and the invitee’s background.

7.2.4 Where the gift is sent directly to CDAM’s premise, it is important that the employee concerned informs the Compliance Officer, registers the Gifts and collectively decides with the Compliance Officer on the next course of action with regards to the Gifts.

7.2.5 Should the gift received be an electronic gadget, watch, pen or similar expensive item, efforts must be made to return the gift to the sender and the Compliance Officer must explain to the third party reasons for returning the gift.

7.2.6 As for gifts received in the form of a hamper containing foodstuff, cookies, drinks or such other items, the gifts have to be registered. The Compliance Officer shall be the temporary custodian of these gifts, until such time/event where the gifts will be fairly distributed to all staffs such as during the Company’s annual dinner or the like. As returning gifts would be viewed as rude by the third party, it is more value adding to manage it since its value is usually low and in conjunction to a festival and/or public event.

7.3 Giving Gifts

7.3.1 In the same vein, CDAM does NOT allow offering any Gifts to third party whether it is in a physical or in an intangible form to reduce the likelihood of misconduct, conflict of interest and corruption, save for special circumstances as envisaged in Section 7.4.2 below.

7.3.2 CDAM takes a strict approach to disallow any political donation or contribution and regard these transactions as high risk. Political donation and contribution include anything given, loaned or advanced, financially or in kind, to support a political party. These can be as simple as allowing potential political candidates to hold talks in the office compound, or as direct as outright donating monetarily to support their campaign. Whilst CDAM’s employees and its Business Associates acting in their own personal capacity are not restricted to making any personal political donations, these are not endorsed or reimbursed by CDAM back to these employees and/or Business Associates.

7.3.3 Giving Gifts in a personal capacity will not generally be perceived as an issue unless the act was done when the person is acting on behalf of CDAM or when performing services for or on behalf of CDAM.

7.4 Procedures and Guiding Principles for Giving Gifts

7.4.1 For the purposes of clarity, all principles on accepting Gifts will be similarly applied to the offering of Gifts, where the circumstances permit.

7.4.2 Exceptions are only allowed where:

(a) the gift(s) is a door gift of the same type and amount received by every recipient during the Company’s event;

(b) the gift(s) is given as a matter of goodwill and custom and is attached to a seasonal greeting card. For example, gift(s) given for a bereavement, recovery from illness, etc, The Gifts should be appropriate and commensurate with the relevant occasion; or

(c) it is a charitable donation or sponsorship made in good faith and in compliance with CDAM’s internal policies.

7.4.3 In the case of a charitable donation and sponsorship, the Company must ensure that the donation is given through legal and proper channels. Particular care must be taken in ensuring that the charities or sponsored organisations on the receiving end are valid bodies and are able to manage the funds properly. Steps must be taken to ensure that donations to foreign-based charities or beneficiaries are not disguised as illegal payments to government officials nor act as conduit to fund illegal activities in violation of any applicable law.

7.4.4 In any case, proper and timely disclosure must be made to the Compliance Officer and the offering of Gifts must first be approved by the management.

7.4.5 If in doubt, you must refer the matter to the Compliance Officer and collectively decide the next step in managing circumstances.

7.4.6 CDAM’s resources, logo, brand or goodwill cannot be used by the employees in giving Gifts without prior written approval of the management.

8. Facilitation Payments

8.1. CDAM prohibits facilitation payments (colloquially known as “duit kopi” in Malaysia) or the ‘under-the-table’ payments which are made to officials to secure, obtain or speed up approvals and routine services, which the officials are required to provide and not to obtain or retain business or any other disproportionate advantage.

8.2. CDAM adopts a zero-tolerance approach that does not allow facilitation payments or kickbacks of any kind. Employees are required to avoid any activity that might lead to any facilitation payments or kickbacks being made or accepted.

9. Record Keeping

9.1. Notwithstanding the Company’s “No Gifts” Policy, all Gifts received and/or given which fall within the list of exceptions under Sections 2 and 7.4 of this Policy and Procedure are subject to the requirement of declaring the Gifts accepted/given, irrespective of its value.

9.2. The Company will ensure that all Gifts are recorded in the register in a timely manner.

9.3. The Company would keep and maintain data, record and documents in accordance with statutory and regulatory requirements.

10. Whistleblowing Channel

10.1. Any director, employee or party who encounters suspected Bribery and Corruption incidents and/or violations of this Policy and Procedure (“Improper Conduct”) are required to promptly report the same to the Compliance Officer via the Incident / Breach Report Form.

10.2. Any external parties who encounter the Improper Conduct may report via email to cdam.compliance@cdam.biz or via post to the Company’s business address.

10.3 Upon receiving the report, the Compliance Officer will :-

(a) Promptly report the Improper Conduct to the Senior Management for further action;

(b) Promptly record the Improper Conduct and the resolution of the breach in the Breach Register which will be tabled during the Board meeting;

(c) Immediately escalate material breaches to the Board besides notifying the relevant authorities.

10.4. Reports made in good faith, either anonymously or otherwise, would be addressed in a timely manner and without incurring fear of reprisal.

11. Communication and Training

11.1. This Policy and Procedure must be appropriately communicated to all CDAM’s employees and Business Associates. These communications would encompass key points of this Policy and Procedure (such as reporting channels, consequences of non-compliance), to whom these points should be communicated to, and how these should be disseminated.

11.2. CDAM disseminates information about its commitment to no tolerance of bribery and corruption via a few mediums to ensure maximum coverage of communication to our business associates and the public, which includes messages displayed on Capital Dynamics’s website as well as contractual agreements between CDAM and its business associates and letters of offers or employment contracts of staff.

11.3. The Company is committed in conducting training/briefings for its Directors and employees to ensure they understand the objectives and implications of the Policy and Procedure so as to continuously promulgate integrity and ethics in their conduct and dealings with external parties for and on behalf of the Company.

11.4. The Company will also provide and/or arrange annual trainings or briefings in relation to the Policy and Procedure.

11.5. Business Associates and other parties that are performing services on behalf of the Company will be notified of the Policy and Procedure including any amendments thereof from time to time.

12. Monitoring, Periodic Review and Disclosure

12.1. Risk assessment serves as the foundation for the composition of an adequate anti-bribery and anti-corruption structure. It allows CDAM to have a systematic view of the risk of bribery and corruption, and as such, gives a clearer perspective on how to design policies and procedures accordingly. A continuous risk assessment will allow CDAM to effectively combat the changing conditions and risks.

12.2. CDAM clearly understands that it has a duty to ensure effective implementation of this Policy and Procedure by identifying potential and/or real internal and external corruption risks within CDAM. As such, the Company is committed to on-going improvement of the Policy and Procedure.

12.3. This Policy and Procedure should be reviewed annually for its effectiveness, adequacy and suitability and may be amended by the Board as and when it deems appropriate.

12.4. The annual internal audit and external compliance review would assist the Company in reviewing the effectiveness, adequacy and suitability of the Policy and Procedure implemented to prevent/counter Bribery and Corruption.